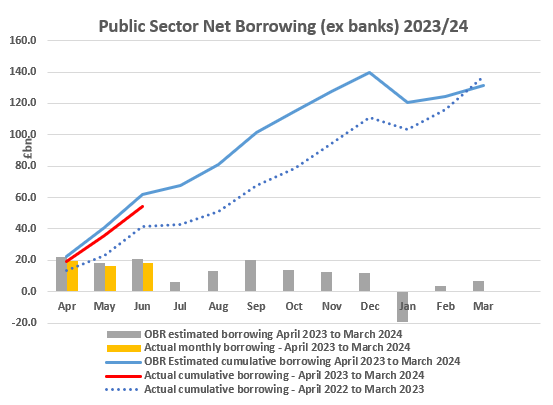

June’s monthly Government borrowing figures. They included £7bn of downwards revisions which brought year to date borrowing below the Office for Budget Responsibility (OBR)’s projections. However, despite the revisions, total debt for June 2023 is above the 100% of GDP threshold.

On Friday, the Office for National Statistics (ONS) published the monthly public sector borrowing data for June 2023. Like the inflation numbers issued on the Wednesday, the borrowing figures were better than had been expected:

- The public sector net deficit ex banks (PSNB ex) in June 2023 is estimated to have been £18.5bn, meaning it was:

- The third highest June borrowing since monthly records began in 1993;

- £0.4bn less than a year ago;

- £0.1bn greater than in June 2021;

- £13.84bn less than in June 2020;

- £2.6bn below the OBR monthly profile projection; and

- £3.5bn below the Reuters economists’ median forecast.

- The latest estimate of total borrowing for the 2022/23 was revised down by £2.1bn to £132.1bn.

- Overall public sector net debt excluding banks (PSND ex) was £2,596.2bn, equivalent to 100.8% of GDP (up 0.9%). Last month’s initial May figure, which just crossed the 100% threshold, was revised down to 99.9% due to a £6.3bn increase in the GDP estimate outpacing a £0.5bn rise in the debt estimate.

In June 2022, debt was 97.3% of GDP and £171.2bn less in cash terms. When the Prime Minister made reducing the debt/GDP ratio one of his five pledges in early January 2023, the then latest figure (for November 2022) was also 97.3%.

- At £12.5bn, the June 2023 interest payments were £3.7bn higher than May’s figure, but £7.5bn less than a year ago. The interest bill was £1.5bn below the OBR forecast, although it still ranked as the third highest payable in any single month on record.

Total interest three months into 2023/24 amounts to £29.8bn, about 1.2% of GDP. Given the UK saw only 0.2% growth in the year to March 2023, that 1.2% serves as a reminder of how difficult it will be to push down the debt/GDP ratio. As the Institute for Fiscal Studies recently pointed out, the interest burden implies that if it is to stand any chance of cutting the debt/GDP ratio, the Government will need to run a large primary budget surplus, i.e. spend significantly less on everything excluding interest payments than its raises in revenue. - Bank of England holdings of gilts (at redemption value) fell by £7.0bn from April to £695.5bn. The gap between the reserves the Bank created to purchase the gilts under QE and their redemption value narrowed by £0.8bn to £107.7bn (counted as Government debt, as the Treasury indemnified the Bank against losses).

The OBR commentary made the following comments:

- Borrowing in the first three months of 2023/24 totalled £54.4bn, £12.2bn above the same period last year but £7.5bn below the OBR’s monthly profile based on its March forecast. This downside surprise is more than explained by higher central Government receipts (£7.7bn above profile) thanks to surpluses across the three major taxes – onshore corporation tax, VAT, and PAYE income tax and national insurance (NICs) – alongside lower borrowing by local authorities.

- Central Government spending at £4.5bn above profile provided a partial offset to the increased tax receipts. Part of this was attributable to the non-consolidated element of the NHS pay settlement.

- HMRC cash receipts were £4.7bn (8.5%) above the OBR profile in June and were up £3.8bn on last June. This strength is explained by:

- Onshore corporation tax cash receipts were £3.1bn (34.9%) above profile and £3.7bn (45.3%) up on last year.

- Cash VAT receipts £1.2bn (15.0%) above profile and £4.2bn (11.4% per cent) higher than the OBR profile for the first three months of the year.

- PAYE income tax and NICs cash receipts were £0.7bn (2.2%) above profile.

Comment

A second piece of relatively good news for the Chancellor will be welcome relief. However, scope for a tax giveaway alongside the Autumn Statement continues to look minimal.

This is an example of one of the recent news bulletins that was posted on our Techlink website. Signing up to Techlink will give you access to original articles, like this, on a daily basis. Techlink also provides you with a comprehensive (and searchable) library of information, daily bulletins on developments of relevance to the industry, multimedia learning and professional development tools. Techlink can also be your ‘gateway’ for accessing consultancy through our ‘ASK’ service which enables you to receive responses to your technical questions from our highly trained technical consultants.

You can sign up for a free 30 day trial of Techlink at anytime. For more information go to www.techlink.co.uk