HMRC has published revised taxpayer data.

Source: HMRC

‘Labour will not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT.’ Labour manifesto 2024

‘As well as cutting National Insurance for 29 million people, we will also not raise the rate of income tax or VAT.’ Conservative manifesto 2024

Those two statements have drawn scorn from some quarters for unnecessarily constraining the future Chancellor and ignoring the difficult spending decisions that must be made by the end of this year. They have also attracted criticism for the way in which they elude the reality of tax increases cloaked in fiscal drag.

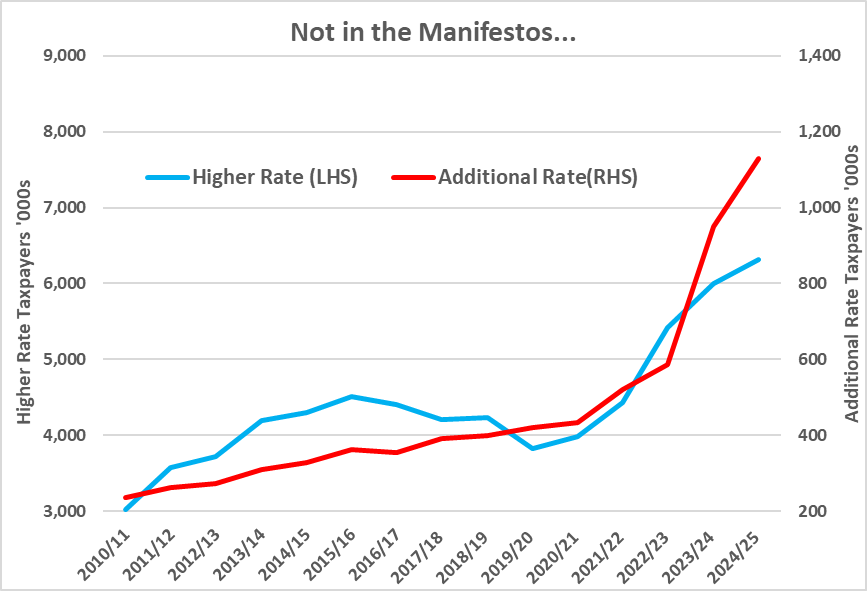

As if to underline the latter point, HMRC has just published its annual update on taxpayer numbers, including estimates for the current tax year, 2024/25. The highlights to emerge include:

- Since 2020/21, the number of UK taxpayers is projected to have risen from 31.7m to 37.4m, a 18% increase at a time when the population rose by about 1.3%. Between 2010/11 and 2019/20 taxpayer numbers grew by just 0.2m.

- Over the same four-year period from 2020/21 the higher rate taxpaying population is projected to have grown from 3.98m to 6.31m, an increase of 58.5% according to HMRC. This statistic measures only marginal higher rate taxpayers, ignoring those who also pay additional rate.

- Additional rate taxpayer numbers over the four years are projected to have leapt from 433,000 to 1,130,000, thanks to that lowering of the additional rate threshold in 2023/24. As a result, 3.0% of taxpayers are projected to be in this category in 2024/25 against just 0.75% when additional rate first appeared in 2010/11.

- Adding higher rate and additional rate taxpayers together, they are projected be 19.9% of the 2024/25 taxpaying population against 13.9% in 2020/21.

- Income tax receipts remain highly skewed towards those facing higher and additional tax rates. That 3% of income taxpayers who pay additional rate is projected to contribute 41.2% of the income tax total in 2024/25, while the (marginal) higher rate population is projected to supply a further 31.1% of the total. The corollary is that 30m basic and savings rate taxpayer population represent 27.7% of the income tax pot. In 2021/22 they supplied 31.6% of income tax receipts.

Comment

The higher and additional rate shares of the taxpayer population are only going to increase further as (manifesto unmentioned) fiscal drag continues. The OBR’s March projections suggest that by 2028/29 the higher rate taxpayer proportion will be 18.5% and additional rate proportion 3.3%, taking the combined figure to 21.8%.

This is an example of one of the recent news bulletins that was posted on our Techlink website. Signing up to Techlink will give you access to original articles, like this, on a daily basis. Techlink also provides you with a comprehensive (and searchable) library of information, daily bulletins on developments of relevance to the industry, multimedia learning and professional development tools. Techlink can also be your ‘gateway’ for accessing consultancy through our ‘ASK’ service which enables you to receive responses to your technical questions from our highly trained technical consultants.

You can sign up for a free 30 day trial of Techlink at anytime. For more information go to www.techlink.co.uk.