Despite its widespread administrative difficulties, the arrival of the new tax year has seen HMRC promptly issue reminders to its ‘customers’ about the need to complete a tax return. But what about those who were dragged into tax in 2023/24 or will be in the current tax year by the cuts to the dividend allowance and/or the capital gains tax annual exempt amount and/or our old friend, fiscal drag?

Dividend allowance

The dividend allowance was £1,000 in 2023/24 and has reduced to £500 for 2024/25. At the time the cuts were announced, in the 2022 Autumn Statement, an HMRC policy paper said ‘It is estimated that this will affect 3,235,000 individuals in the year 2023/24 and 4,405,000 individuals in the year 2024/25. Around 46% of those with taxable dividend income will be unaffected by this measure in the year 2023/24, falling to 27% in the year 2024/25.’

About 65% of taxpayers are outside the self-assessment regime and some of them will have tax to pay on their 2023/24 dividends for the first time. If such a taxpayer runs through the HMRC ‘Check if you need to send a Self Assessment tax return’ webtool, they will probably reach a page which says ‘Based on your answers, you do not need to send a return for 2023 to 2024.’ It then goes on to say:

Why the page still refers to £2,000 of dividend income is unclear – it looks suspiciously like a lack of updating from 2022/23. The ‘check your Income Tax” option needs the individual to sign in to their personal tax account using their Government Gateway user ID and password. Many outside self-assessment will, therefore, need to create a personal tax account first, before going any further. In theory the taxpayer also has the option of filing a self-assessment return – something that might be quicker than calling HMRC. However, online self-assessment also requires a personal tax account as paper returns cannot be downloaded from the internet. They can be requested from HMRC, but, in theory, HMRC will want a reason why the individual cannot file online.

Capital gains tax

The annual exempt amount was £6,000 in 2023/24 and has reduced to £3,000 for 2024/25. In the 2022 Autumn Statement, HMRC’s policy paper said ‘it is estimated that for the year 2023/24 around 500,000 individuals and trusts per year could be affected, increasing on a cumulative basis to 570,000 in 2024/25. Of this group, by 2024/25, it is estimated that 260,000 individuals and trusts will be brought into the scope of CGT for the first-time.’

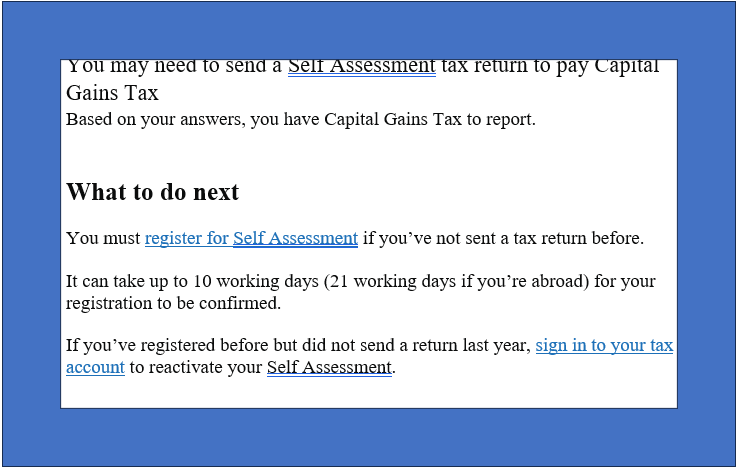

The HMRC self-assessment webtool asks ‘Do you need to pay any Capital Gains Tax?’ Unhelpfully, it also says ‘You usually have to pay Capital Gains Tax when you sell or give away most personal possessions worth £6,000 or more (apart from your car) or any other assets, such as shares or a holiday home’ without mentioning the annual exemption or anchoring the instruction to the gain that you make rather than the amount you receive or are deemed to receive. Answer ‘yes’ to the question and the result is:

The contrast between ‘may need to’ and ‘must’ register is an odd one, as is the fact that there is different treatment of capital gains in the webtool and self-assessment:

- In the webtool, the question is about whether there is capital gains tax to pay.

- In self-assessment, the requirement to complete the capital gains tax pages (SA108) is triggered if:

- disposals exceed £50,000; or

- gains before losses exceed the annual exemption.

In practice, the safety-first approach would be to follow the SA108 trigger, even if net gains are below the annual exemption. It is better to give HMRC too much information rather than rely on a defence of ‘I was following the webtool’ when HMRC start asking questions.

Fiscal drag

The Office for Budget Responsibility (OBR) has calculated that, in 2023/24, there were 36.2 million taxpayers, 1.9 million more than if the personal allowance had been indexed. For 2024/25, the corresponding figures are 37.2 million and 3.2 million. Many of those will be dragged into tax because of:

- Rises in State or other pensions, or

- Interest income exceeding their personal savings allowance (and any available starting rate for savings band) because of rising interest rates since the end of 2021.

As far as State Pensions are concerned, the DWP supplies HMRC with details of payments (including in advance, so that tax codes can be determined). Where there is a tax liability arising as the result of a State Pension and tax cannot be collected via a PAYE code from other (non-State) pensions or earnings, then HMRC will issue a Simple Assessment with a demand to pay. This will be happening more frequently now, even though both the old State Pension (£8,814 in 2024/25) and new State Pension (£11,502 in 2024/25) are below the personal allowance. Extra State Pension entitlements, mostly from the pre-2016 additional pension, are the reason for total benefits exceeding the £12,570 of the personal allowance.

New tax liabilities on non-State pensions are normally automatically dealt with via the PAYE code. If the tax liability arises because of investment income, then the process is the same as outlined above for dividends – the taxpayer needs to inform HMRC.

Comment

The Government has loaded more tax collection work onto HMRC and has done little to reduce it beyond raising the automatic threshold for self-assessment from £100,000 to £150,000 for 2023/24 onwards. That move has itself been criticised because of the importance of the £100,000 threshold in terms of the personal allowance and tax-free childcare.