The National Insurance Contributions (Reductions in Rates) Bill has already had its second reading in the House of Lords as the Government has requested that Parliament fast track the legislation. The need for speed stems from the 6 January 2024 start date for the primary Class 1 NIC reduction, a timing that many see as politically motivated. As the Bill’s explanatory note wryly observes, ‘It is important for …employers to have as much time as possible to implement the changes to their payroll software ahead of the rate reduction.’

Aside from the headlined ‘tax cuts’, the NIC changes have several indirect effects which have received little attention:

Directors’ NICs

The calculation of NICs for directors is based on their full tax year income. This means that, as happened in 2022/23 when there was a NICs cut, a pro-rata Class 1 NICs rate will apply in 2023/24. For this tax year that will mean a main primary rate of 11.5%, as set out in para 1 of the Schedule to the Bill. Any director thinking that, by deferring payment to 6 January, they will pay 10% NICs on a bonus falling with the main primary NICs band (£12,570 to £50,270) is wrong. To get the full benefit of the lower NICs rate, deferment would need to be until 6 April 2024…at which point other considerations may come into play.

The 11.5% is simply calculated as 12% x ¾ + 10% x ¼.

As both the secondary Class 1 NIC rate and the 2% primary Class 1 NIC rate on earnings above the upper earnings limit are unchanged, no pro-rating applies to these.

Bonus v dividend

There is no change in the numbers where the marginal income tax rate is above basic rate as the relevant marginal NIC rate stays at 2%. At a marginal basic rate, the bonus/salary option becomes slightly less unattractive than a dividend but remains well adrift. For example, in 2024/25, taking the highest marginal corporation tax rate, the numbers look like this:

| Bonus | Dividend | |

| Gross profit | 1,000.00 | 1,000.00 |

| Corporation tax (26.5%) | N/A | (265.00) |

| Dividend payable | N/A | 735.00 |

| Employer’s NIC (13.8%) | (121.27) | N/A |

| Bonus | 878.73 | N/A |

| Employee’s NIC (10%) | (87.87) | N/A |

| Income tax (20%/8.75%) | (175.75) | (64.31) |

| Net Income | 615.11 | 670.69 |

Incorporation v self-employment

Our last Bulletin on the question of incorporation made clear that the higher corporation tax rate environment had reduced the tax appeal of incorporation. The calculations for this adopted the assumptions that:

- £9,100 (the employer NIC secondary threshold) would be drawn as salary from the company, as this would be NIC-free for the company and its director; and

- The entire balance of gross profit would be subject to corporation tax and drawn as dividends; and

- The dividend allowance (falling to just £500 in 2024/25, remember) was not available.

These assumptions mean that the employee NIC cut is irrelevant. However, on the self-employed side, there are two relevant NIC reductions:

- An end to Class 2 NIC contributions, worth £179.40 a year; and

- A reduction in the Class 4 NIC rate from 9% to 8%, worth a maximum of £377 a year where profits are at least £50,270.

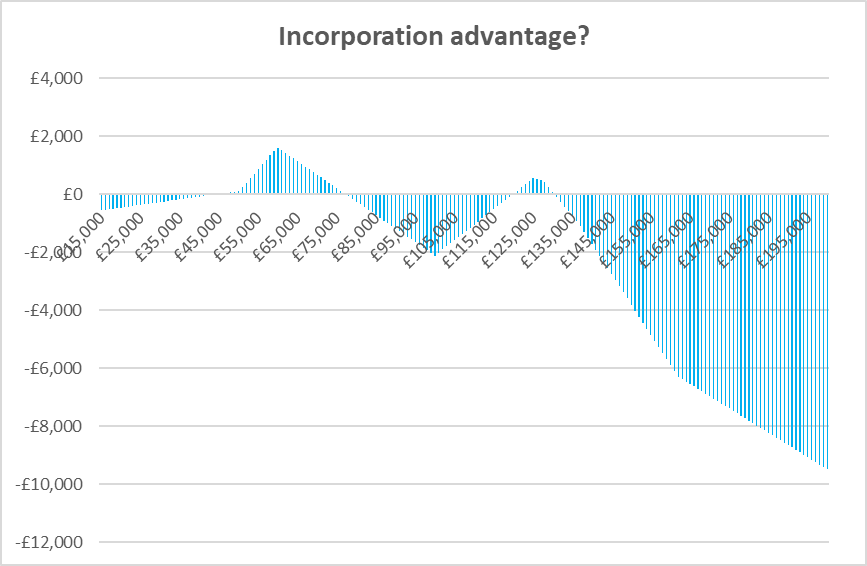

As a result, the incorporation advantage can be up to £556.40 a year less in 2024/25 than 2023/24. Reworking the graph in the previous Bulletin produces this pattern.

The two bands in which incorporation has a theoretical tax advantage have narrowed because of the NICs savings on self-employment, with the maximum gain about £1,600 at £60,000 of profit. Both the bands favoring incorporation have their roots in the absence of grossing up for dividend income. In the first band, that means income attracting higher rate tax arrives at a greater gross profit level. For the second, the absence of grossing up pushes out the point at which the personal allowance begins to be phased out.

Comment

The waning attraction of incorporation will not disappoint HMRC, as it continues its off-payroll working (IR35) battles. It may also encourage some users of personal companies to review the alternative of self-employment (although this needs to also consider the non-fiscal beneficial aspects of trading as a company).

This is an example of one of the recent news bulletins that was posted on our Techlink website. Signing up to Techlink will give you access to original articles, like this, on a daily basis. Techlink also provides you with a comprehensive (and searchable) library of information, daily bulletins on developments of relevance to the industry, multimedia learning and professional development tools. Techlink can also be your ‘gateway’ for accessing consultancy through our ‘ASK’ service which enables you to receive responses to your technical questions from our highly trained technical consultants.

You can sign up for a free 30 day trial of Techlink at anytime. For more information go to www.techlink.co.uk.